Pioneering New Approaches in Business Spending During Economic Challenges

Sandra Okoro

31st January, 2024

As we look towards 2030, businesses across Africa are gearing up for a significant increase in spending, with projections indicating a rise from $1.6 trillion in 2015 to an impressive $4.2 trillion. This surge is anticipated mainly in key sectors like agriculture, manufacturing, construction, and transportation. Despite this growth, managing business-to-business (B2B) expenses remains a predominantly manual and inefficient process, plagued by errors and disorganization. Such challenges not only elevate operational costs but also hinder the processes of financial institutions.

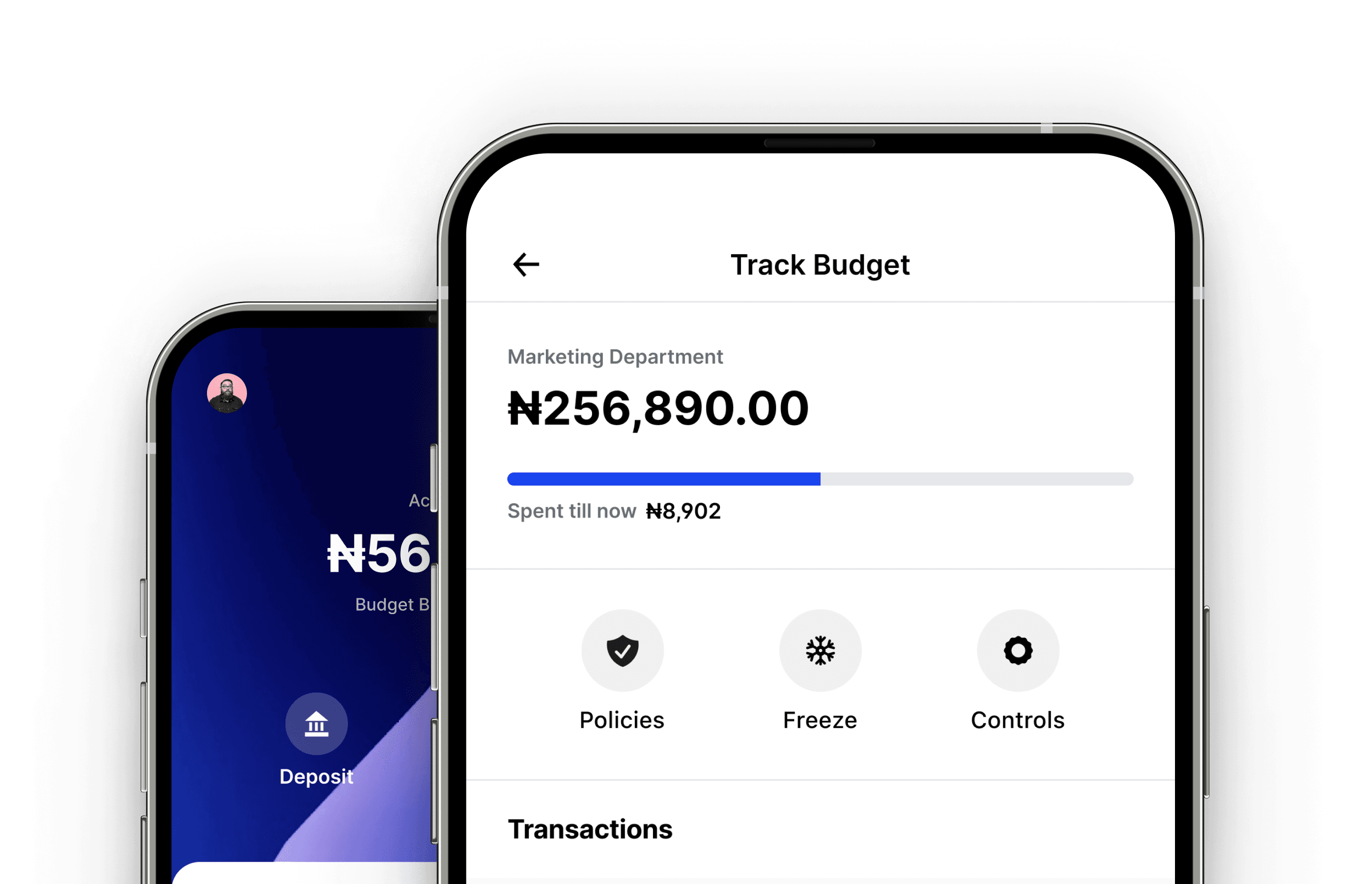

In this evolving landscape, Chequebase emerges as a transformative solution. This comprehensive platform is revolutionizing how African businesses manage their B2B expenditures. By integrating expense tracking, vendor payments, and the issuance of employee corporate cards, Chequebase simplifies and digitizes financial management. It offers a range of services across major commercial payment avenues, including mobile and web platforms, as well as corporate cards. Its model is akin to established services like Brex in the United States, Spendesk in Europe, and Clara in Latin America.

Understand Exactly How Your Business Spends Over Time

The Timing for Chequebase

Three critical factors favor the emergence of Chequebase. Firstly, the need to control expenses is amplified in high inflation scenarios. Secondly, the burgeoning acceptance of fintech companies as reliable partners, a trend initiated by early fintech adopters in Africa like Interswitch and Flutterwave, lays a solid foundation. Evidence of this trend is the increasing volume of financial transactions processed through Nigeria's Central Bank system by fintechs, surpassing those by traditional banks. Finally, recent economic policies across Africa, aimed at enhancing cross-border trade and promoting cash digitization, are pivotal. Notable among these is the African Continental Free Trade Area (AfCFTA), which is set to unlock enormous economic potential by establishing a unified trade bloc, akin to the European Union.

Nigeria's Strategic Role

Nigeria's fintech landscape in 2021 positioned it as the sixth-largest instant payment infrastructure globally, surpassing the United States and closely trailing the United Kingdom. Financial innovation is a key driver of Nigeria's economic growth. By establishing its base in Nigeria, Chequebase is not only tapping into a significant initial market but is also leveraging the continent's most sophisticated financial infrastructure. This strategic decision gives Chequebase an edge, as competitors developed outside Nigeria might face technical challenges adapting their platforms for the Nigerian market.

You may also like...